|

People often say that investing has become much harder in recent years.

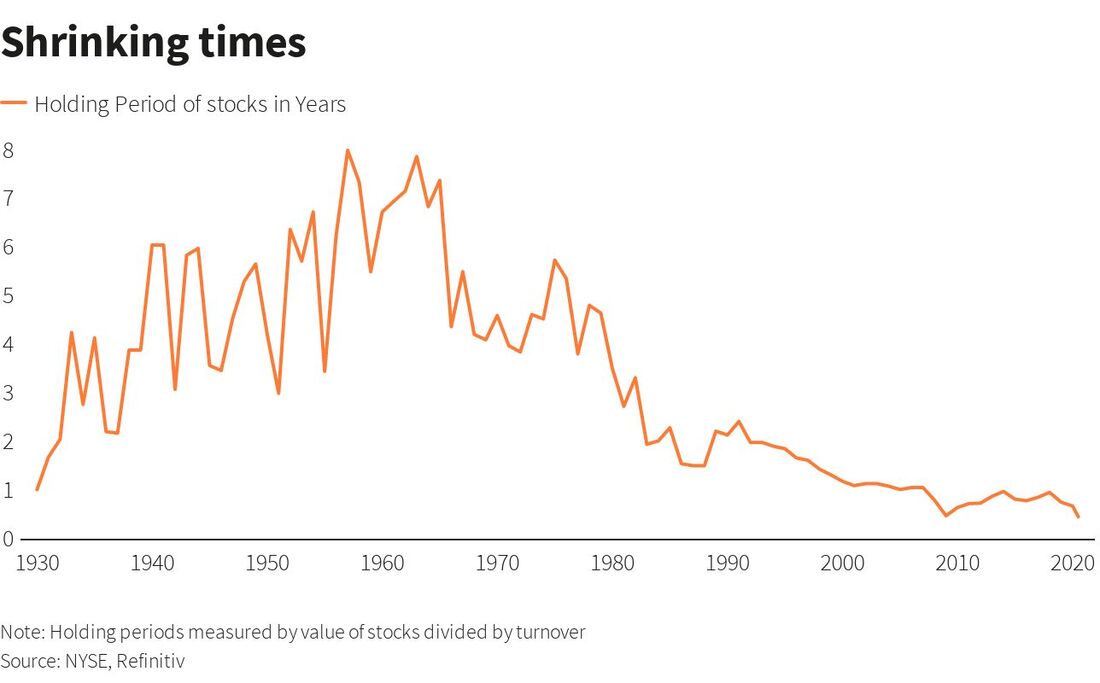

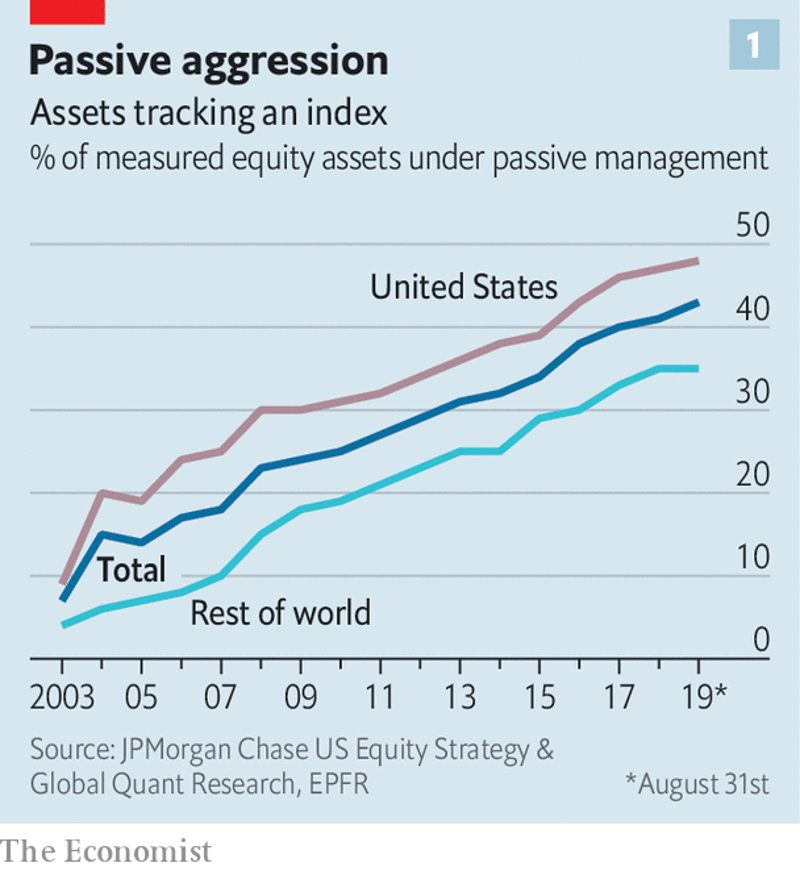

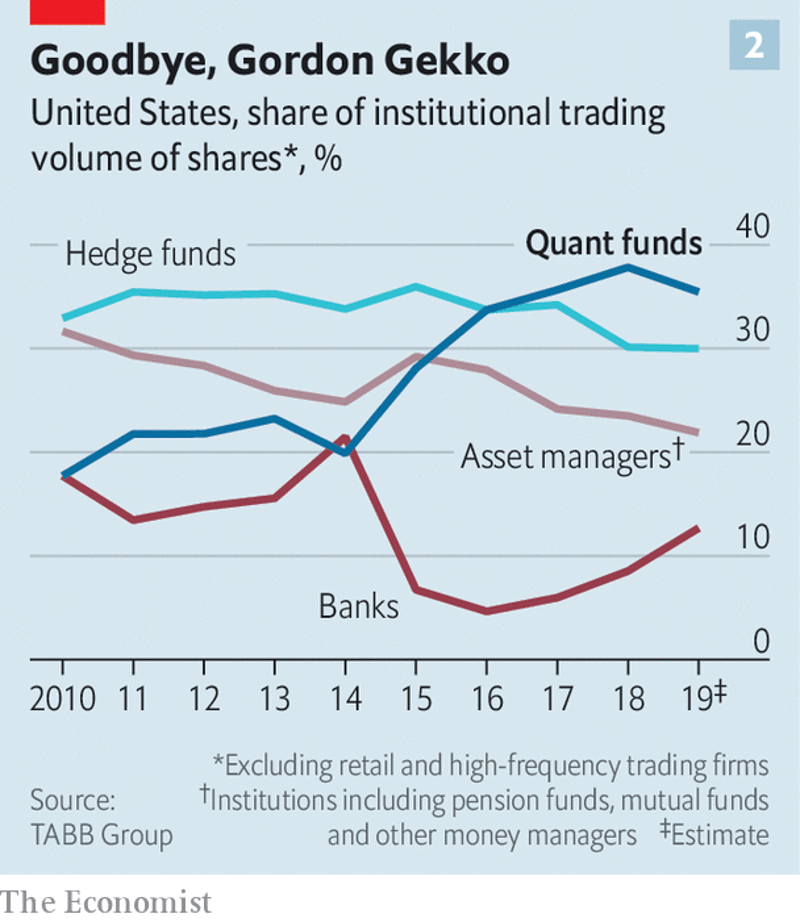

With the internet, the democratization of information, advanced analytical tools, and armies of sophisticated and driven analysts chasing alpha, I agree that it has become much more competitive. But what if the increasing importance of different styles, such as algorithmic trading, global macro, trend following, passive ETF flows, risk parity, etc., and the ever-shortening time horizon of investors, all combine to move prices faster and further for non-business-fundamentals reasons? Perhaps the long-term fundamentals-based investor still has the occasional opportunity to find temporarily mispriced great businesses.

0 Comments

|

AuthorFounder and Chief Investment officer of Alphyn Capital Management, LLC. Archives

June 2023

Categories |

RSS Feed

RSS Feed