|

The answer is it depends :) if you have any questions, don’t hesitate to reach out

0 Comments

When selling a business, the sooner you start planning, the better. Even if your exit stage is a few years away, engaging in strategic planning and budgeting now will help maximize value and future income potential. Not only can this increase the chances of a successful sale, but any extra income generated in the meantime can be invested back into the business, so you don’t have to sell to engage our services.

Just as growing a business takes time and effort, so does exiting or selling it. It is essential to develop an exit plan that accounts for financial and non-financial goals, such as avoiding legal fees and protecting proprietary information. This plan should also include tactics for maximizing value over time by investing in areas like talent retention, marketing, automation, and scalability. Plus, you should consider factors like taxes, legal requirements, and other contingencies that may occur during the sales process. Perhaps most importantly, entrepreneurs should remember that preparing for a sale involves more than just financial planning; it also requires building relationships with potential buyers who will understand your company's value and pay accordingly. To do this effectively requires getting to know key players in your industry beforehand so you have an idea of who might be interested in purchasing your business down the line and how they will respond when presented with an offer. Setting Growth Metrics for Your Business The first step to growing your business is to set clear and achievable goals. This begins with identifying what metrics you wish to improve. Examples of metrics include:

Businesses should also develop strategies for achieving these goals. These strategies include diversifying into new markets, creating incentives for customers or employees, investing in technology, or working with partners who can scale up your operations. Maximizing the Value of Your Business When Exiting When it comes time to sell your business, it's essential to maximize its value by researching potential buyers and preparing an attractive package of assets that appeal to them. It's also important to assess any potential liabilities that may impact the sale price since they will likely be included in the purchase agreement. Additionally, entrepreneurs should consider whether they would like to transfer ownership through a sale or liquidation of assets. By understanding these factors before approaching buyers, businesses are more likely to maximize their value when exiting the market. Plus, even if you aren't selling, expanding your cash flows provides investment opportunities sooner. Remember, compound interest affects everything, and the sooner you reinvest, the more time your money has to grow. Strategies for Paycheck Replacement When transitioning out of the business world, many entrepreneurs want a reliable source of income during retirement. You must work out your living expenses ahead of time and backsolve for the amount of assets you will need in order to provide enough income to maintain your lifestyle. At Alphyn, in addition to regular bond and dividend investing, we can provide access to private real estate and debt funds run by some of the most recognized and respected names in the private equity world. When used judiciously, these can increase yields, and diversification and reduce volatility. Additionally, setting up trusts or other investments that provide income streams may increase financial security and safeguard family wealth for future generations without compromising current lifestyle choices. Building a Legacy with Asset Positioning One of the most important decisions when selling a business is how to utilize the proceeds wisely. We highly recommend asset positioning to ensure that owners and their families are well-positioned for success in the future. This process involves making strategic investments that are positioned to gain in value and provide income over time so you can enjoy the benefits of financial freedom in retirement or pass on an inheritance to your heirs. Most business owners have the majority of their net worth tied up in their business. This is understandable; after all it is where they have dedicated their time and energy for years, what they understand best, and what they know how to manage and control. nevertheless, positioning should involve diversifying your investments into carefully chosen securities. to minimize risk while maximizing returns over time. Capital Appreciation Investments to Consider At Alphyn, we focus on Investing for capital appreciation, as we believe it is an excellent way to increase personal wealth over time. With 25 years in the markets, we have honed the process to carefully select what we believe are excellent high-quality public equities, hand-selected funds run by proven investors with strong track records. It would be our pleasure to share these ideas with clients who are so inclined to learn more about our portfolio thesis and discuss their financial objectives. Compounding Income Options for Long-Term Profitability Compounding income is another great way for savvy business owners and entrepreneurs to grow wealth without taking on too much risk. One of the most popular compounding income options is dividend investing, where investors buy stocks that pay a steady stream of dividends each quarter or year from companies they own a piece of. This allows investors to reinvest these dividends back into the stock market at minimal cost and create long-term growth without breaking the bank. One advantage of dividends is that they are less volatile than share prices and typically do a good job of keeping ahead of inflation. Other we can discuss the relative merits of dividends vs. other income options, including Treasury bills, CDs, or bonds, which provide guaranteed returns over a fixed period minus some risk since there is no potential upside. Leveraging Expertise and Experience for Maximum Return on Investment Having been involved in finance, investing, and business operations over 25 years, I understand that proper planning is critical to getting the maximum return on investment. When it comes to growing and selling businesses, there are a few areas where extra attention needs to be paid:

First, research is essential. Knowing who your competitors are and their success strategies will help you develop strategies that can be used to stand out from the crowd. Additionally, researching industry trends and ensuring you're up-to-date with the latest news can help you stay ahead of any potential issues or opportunities. An in-depth knowledge of your industry's ins and outs will help you make more informed decisions when it comes time to negotiate with buyers or investors. Second, setting up a strong foundation is essential for businesses seeking growth. This involves having a clear mission statement that will guide all future decisions made by management and staff alike; diversifying revenue streams in case one sector takes an unexpected hit; leveraging technology such as AI or automation to increase productivity; implementing effective marketing strategies that reflect current trends; and having access to reliable external sources such as debt or equity financing should cash flow becomes strained. Thirdly, developing an exit plan is key for business owners looking to maximize their return on investment when selling their business. Exiting a business requires understanding prospective buyers' or investors' needs entirely so that you can accurately discuss how your company meets those requirements. Additionally, doing due diligence upfront can help ensure buyers are fully aware of any risks associated with purchasing your company before they sign on the dotted line. Lastly, knowing when it's time to walk away from negotiations is equally important: if either side isn't achieving what they want from the deal, then both parties should look at other options instead. Final Thoughts: Get Maximum Value Out Of Your Hard Work! Growing and selling businesses is difficult, but careful planning and leveraging experience in finance, investing, and business operations can result in significant returns on investment. Doing extensive research before entering negotiations will give you leverage over buyers or investors while also helping you identify potential opportunities or issues down the road; setting up a solid foundation through diversification of revenue streams and implementation of effective tactics like automation or marketing will make sure that you're maximizing efficiency before sale; finally laying out a detailed exit plan including knowing when it's time to walk away from negotiations will ensure that both sides are happy with any agreements reached resulting in maximum value out of all hard work put into growing and selling businesses safely!

I’ve used “synthetic leverage” to describe when a company employs someone else’s resources, like capital or operations, to generate additional income. An example is Warren Buffett’s use of insurance float at Berkshire Hathaway – he used the money from insurance policies to invest in stocks and buy businesses. In other words, he borrowed the money instead of using his own resources!

As you know, using borrowing money to make investments, otherwise called using leverage, can be extremely risky. If your investments lose enough value, the bank or brokerage can force you to post margin (put up more collateral) or call the loan at the worst possible time, forcing you to realize a catastrophic loss. Crucially, Buffett’s insurance float is non-recourse and not marginable. No one can force him to pay back the loan. So while he still has to make suitable investments, he can be much less worried about catastrophic drawdowns, the kind that has happened to many intelligent and sophisticated investors over time. For example Long Term Capital Management in 1998 (which was 2 Nobel laureates no less) and more recently, Archegos Capital that made financial headlines in 2021. Some analysts published a study on Buffett’s 40-year performance and found that his underlying investments grew at 15% per year. That is a fantastic long-term track record. However, this is the special part: with his NON-RECOURCE leverage, his returns moved up to nearly 25%. Over 40-something years, that can make a massive difference, between making around 250x your money and making 7,500x your money. There is a reason Warren Buffett is so revered in the investment community. Most investors can’t access these kinds of situations. And I don’t use any leverage in money that I manage. But I try to fill the portfolio with other large public companies with synthetic leverage. Focusing on companies that can take advantage of synthetic leverage can increase our chances of success and make more money from our portfolio. We don’t need to make Buffett-like returns to still be very happy, as focusing on companies with synthetic leverage can help us get more bang for our buck! If you’d like to find out more, please don’t hesitate to reach out. People often say that investing has become much harder in recent years.

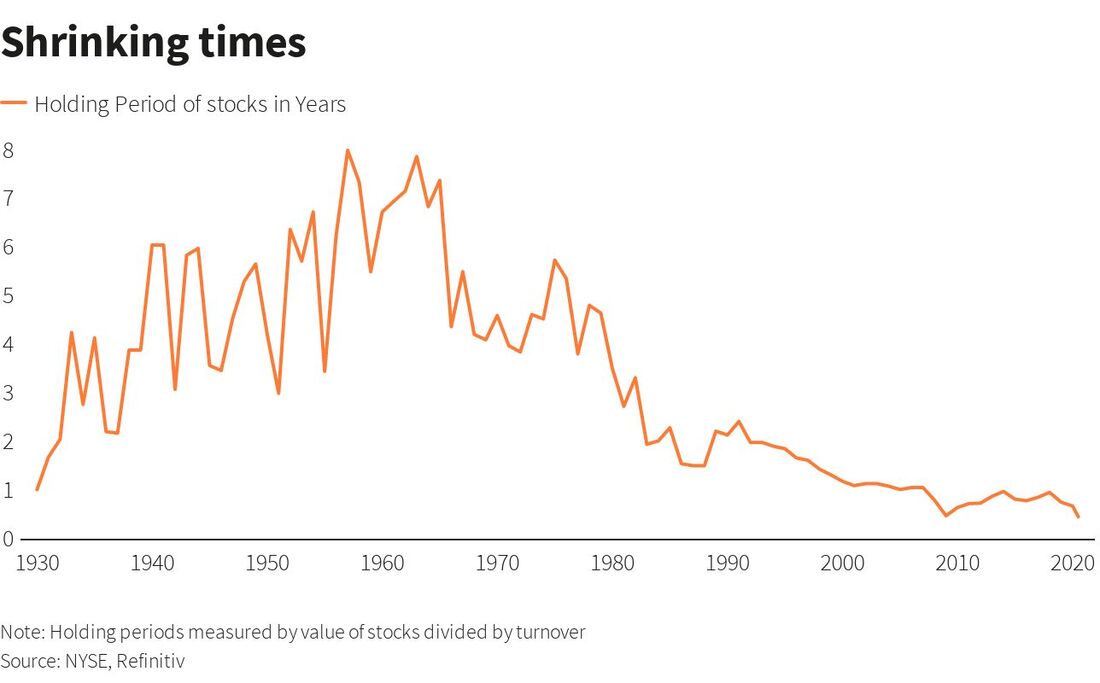

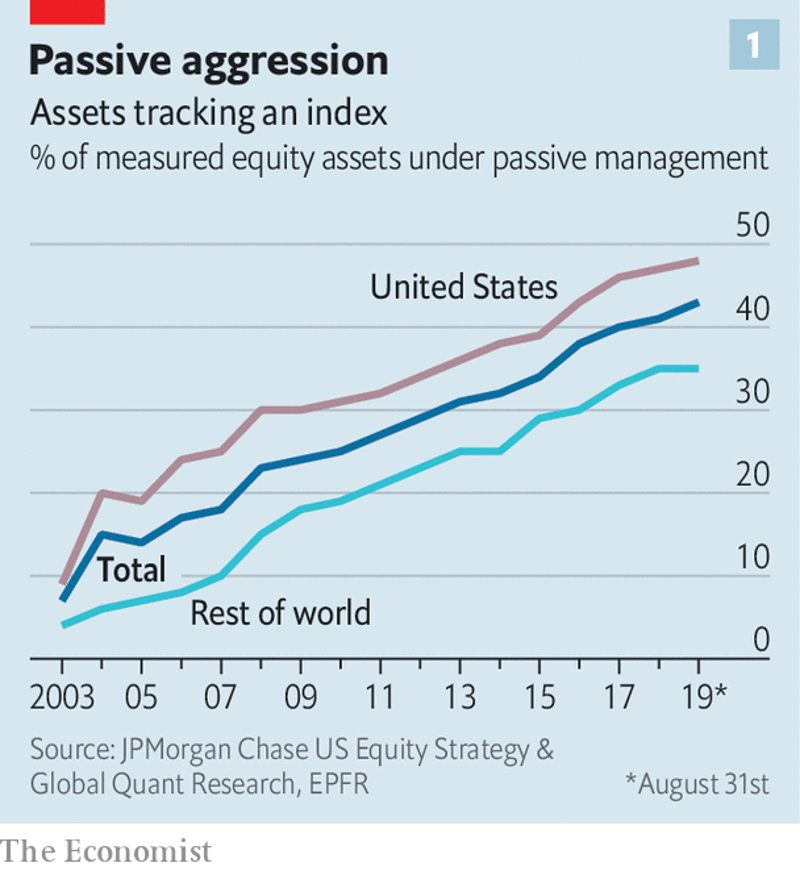

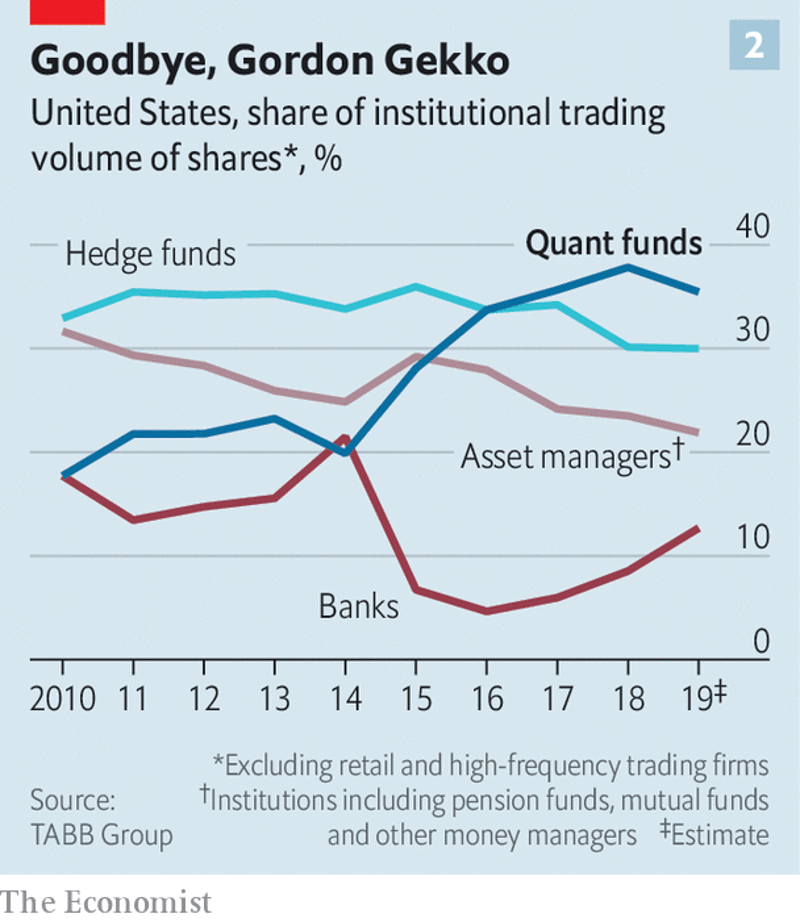

With the internet, the democratization of information, advanced analytical tools, and armies of sophisticated and driven analysts chasing alpha, I agree that it has become much more competitive. But what if the increasing importance of different styles, such as algorithmic trading, global macro, trend following, passive ETF flows, risk parity, etc., and the ever-shortening time horizon of investors, all combine to move prices faster and further for non-business-fundamentals reasons? Perhaps the long-term fundamentals-based investor still has the occasional opportunity to find temporarily mispriced great businesses. I was honored to be invited on the Value Hive podcast to discuss the investment merits of Ashtead Group Plc (LSE: AHT).

Thanks to Brandon Beylo for a fun discussion. We discuss Ashtead's history, business, competitive advantages, unit economics, value, and why I believe there is potential for future free cash flow margin expansion and revenue growth. (Plus, I share some of my investment journey such as how I managed to own a Caribbean supermarket) https://podcasts.apple.com/us/podcast/value-hive-podcast/id1492171651?i=1000587476466 |

AuthorFounder and Chief Investment officer of Alphyn Capital Management, LLC. Archives

June 2023

Categories |

RSS Feed

RSS Feed